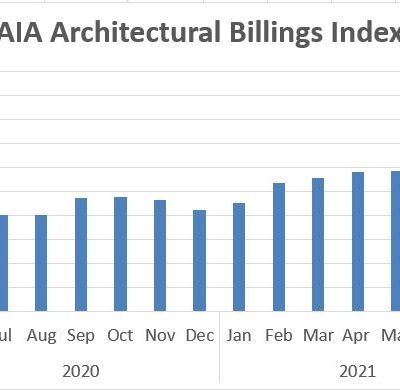

The Architecture Billings Index (ABI) recorded its sixth consecutive positive month in July 2021, according to The American Institute of Architects (AIA).

Construction + Economy

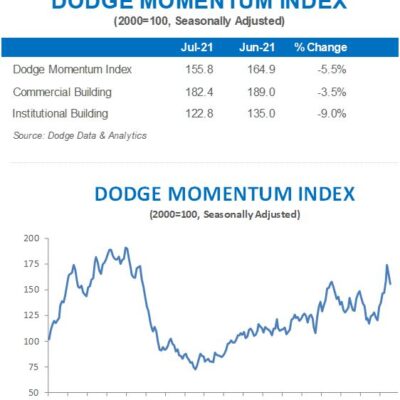

Dodge Momentum Index Retracts in July

The Dodge Momentum Index fell to 155.8 (2000=100) in July, a 6% decline from the revised June reading of 164.9. The Momentum Index, issued by Dodge Data & Analytics, is a monthly measure of the first (or initial) report for nonresidential building projects in planning, which have been shown to lead construction spending for nonresidential buildings by a full year.

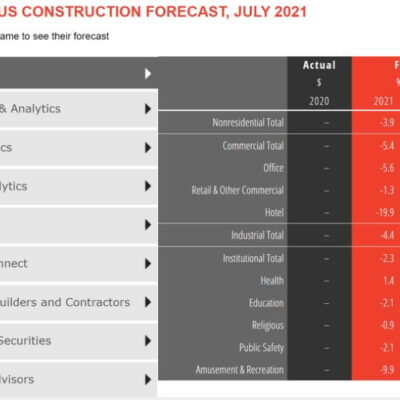

AIA Mid-Year Forecast: Softer Nonresidential Construction Decline in 2021, Healthy Growth in 2022

Pent-up demand from the pandemic is creating a general spending surge that is helping to improve the outlook on construction spending over the next two years, according to the American Institute of Architects (AIA).

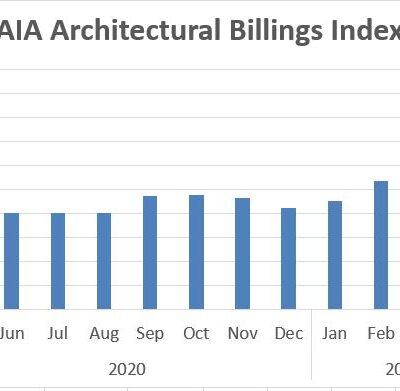

Architecture Billings Index Robust Growth Continues

Architecture firms reported increasing demand for design services in June 2021, according to The American Institute of Architects (AIA).

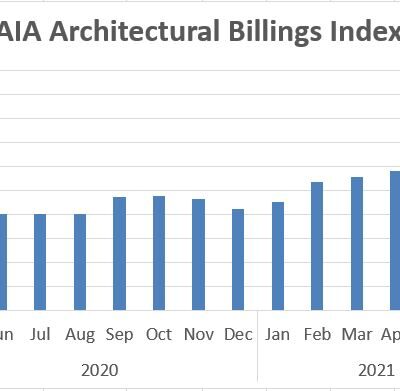

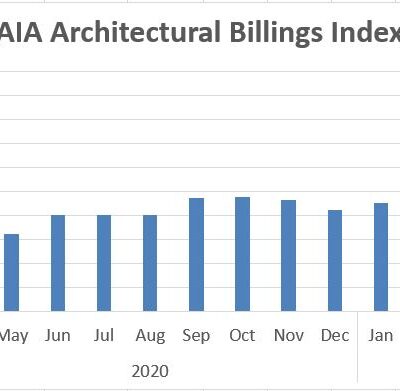

Increasing Design Activity Signals Construction is Recovering

Continuing its strong rebound, the Architecture Billings Index (ABI) recorded its third consecutive month of positive billings, according to The American Institute of Architects (AIA).

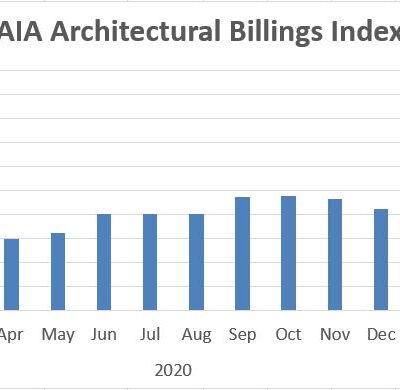

Demand for Design Services Continues Positive Trend

In March 2021, the Architecture Billings Index (ABI) logged its second positive mark since the beginning of the pandemic, according to The American Institute of Architects (AIA).

Architecture Billings Climb into Positive Territory

Continuing the positive momentum of a nearly three-point bump in January, the Architecture Billings Index (ABI) reached its first positive mark since February 2020, according to The American Institute of Architects (AIA).

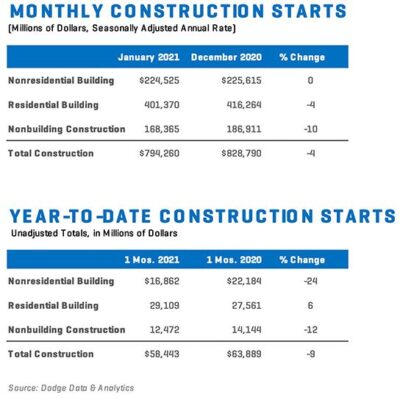

Total Construction Starts Down to Begin 2021, But Nonresidential Stable

Total construction starts dropped 4% in January to a seasonally adjusted annual rate of $794.3 billion. Nonresidential building starts were flat in January, while nonbuilding starts dropped 10% and residential starts were 4% lower. From a regional perspective, starts were lower in three of the five regions – the Midwest, South Atlantic, and South Central. Starts rose, however, in the Northeast and West.

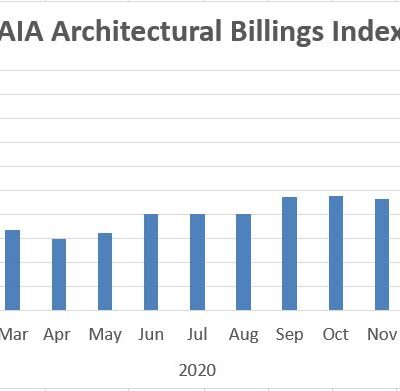

Architectural Billings Continue to Contract in 2021

A slight improvement in business conditions has led to fewer architecture firms reporting declining billings, according to The American Institute of Architects (AIA).

Dodge Momentum Index Increases to Start 2021

The Dodge Momentum Index increased 3.1% in January to 139.4 (2000=100) from the revised December reading of 135.2. The Momentum Index, issued by Dodge Data & Analytics, is a monthly measure of the first (or initial) report for nonresidential building projects in planning, which have been shown to lead construction spending for nonresidential buildings by a full year. January’s increase marked the highest level in the Momentum Index since the COVID-19 pandemic began.